With enthusiasm, let’s navigate through the intriguing topic related to The Wolf of Sustainable Investing: How ESG is Reshaping Global Capital Markets. Let’s weave interesting information and offer fresh perspectives to the readers.

The Wolf of Sustainable Investing: How ESG is Reshaping Global Capital Markets

The world of finance is changing, and the wolf at the door isn’t a greedy Wall Street broker. It’s a new breed of investor, driven by a growing awareness of environmental, social, and governance (ESG) factors. This "Wolf of Sustainable Investing" is hungry for positive impact, and its appetite is driving a dramatic shift in global capital markets.

The Numbers Don’t Lie: A Surge in Sustainable Funds

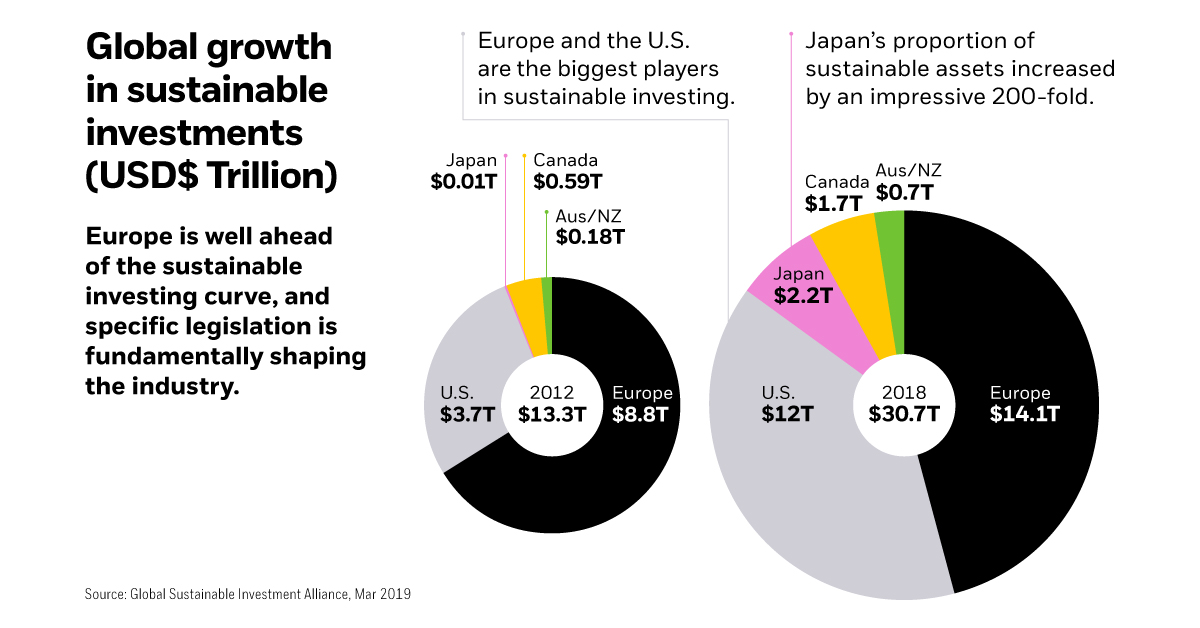

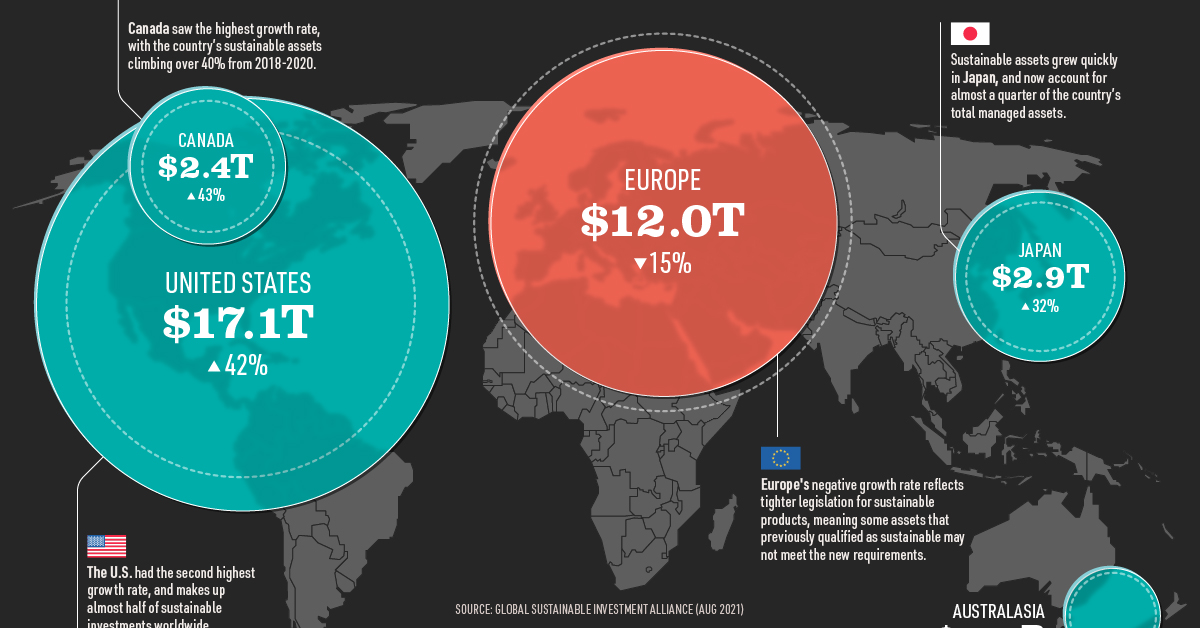

The roar of the sustainable investing movement is undeniable. Assets under management (AUM) in sustainable funds have skyrocketed in recent years. According to Morningstar, global sustainable fund AUM reached a staggering $3.8 trillion in 2021, a 35% increase from the previous year. This exponential growth is a testament to the increasing demand for investments aligned with ethical and responsible principles.

The Drivers of Change: A Multifaceted Force

The trend towards sustainable investing is not a passing fad. It’s fueled by a confluence of factors, each contributing to the growing appeal of ESG-focused investments:

- Millennial and Gen Z Investors: This generation, known for its social consciousness and digital savvy, is prioritizing investments that align with their values. They are actively seeking companies with strong environmental and social practices, pushing for a more sustainable future.

- Institutional Investors: Pension funds, insurance companies, and other large institutional investors are increasingly incorporating ESG factors into their investment strategies. They recognize the long-term risks associated with unsustainable practices and the potential for financial returns from companies with strong ESG performance.

- Regulatory Pressure: Governments worldwide are enacting stricter regulations related to climate change and corporate social responsibility. This regulatory pressure is incentivizing companies to adopt sustainable practices and pushing investors towards ESG-focused investments.

- Growing Awareness of Environmental Risks: Climate change, resource depletion, and pollution are increasingly recognized as significant financial risks. Investors are seeking to mitigate these risks by investing in companies that are actively addressing environmental challenges.

- Social Impact Investing: Investors are increasingly seeking investments that generate positive social impact alongside financial returns. This trend is driving the growth of impact investing, a form of sustainable investing focused on creating measurable social and environmental benefits.

The Wolf of Sustainable Investing: How ESG is Reshaping Global Capital Markets

The Impact on Companies: A New Era of Accountability

The growing influence of sustainable investing is forcing companies to adapt and prioritize ESG factors. Companies that fail to meet the expectations of ESG-conscious investors face a range of challenges:

- Increased Scrutiny: Companies are facing greater scrutiny from investors, activists, and the media regarding their environmental and social practices. This scrutiny can lead to reputational damage and financial penalties.

- Access to Capital: Companies with poor ESG performance may find it increasingly difficult to access capital from investors. This could limit their ability to grow and compete in the market.

- Employee Retention: Attracting and retaining top talent is becoming more challenging for companies with weak ESG credentials. Millennials and Gen Z employees are prioritizing working for companies that share their values.

The Future of Finance: A Sustainable Future

The rise of sustainable investing is fundamentally changing the landscape of global capital markets. It’s ushering in a new era of accountability, where companies are judged not only on their financial performance but also on their environmental and social impact. This shift has far-reaching implications:

- Increased Investment in Sustainable Technologies: The growing demand for sustainable investments is driving capital towards innovative companies developing solutions to climate change and other environmental challenges. This could lead to breakthroughs in renewable energy, clean transportation, and resource efficiency.

- Improved Corporate Governance: The focus on ESG factors is prompting companies to improve their governance practices and transparency. This could lead to more ethical and responsible decision-making within corporations.

- Greater Social Impact: Sustainable investing is fostering a more inclusive and equitable financial system. It’s directing capital towards projects that address social challenges like poverty, inequality, and access to healthcare.

The Future of Finance: A Sustainable Future

The Wolf of Sustainable Investing is a force to be reckoned with. Its roar is a call for change, a demand for a more responsible and sustainable future. As investors continue to prioritize ESG factors, the global capital markets will continue to evolve, driving a shift towards a more ethical and impactful financial system.

Beyond the Numbers: A Deeper Dive into the ESG Landscape

While the growth of sustainable funds is a clear indicator of the trend, a deeper dive into the ESG landscape reveals a more nuanced picture:

Related Articles: The Wolf of Sustainable Investing: How ESG is Reshaping Global Capital Markets

- A Green Tide: Sustainable Investing Surges In Global Capital Markets

- The Golden Age Of Sustainable Investing: Whiskey Investors Seek A Sip Of Ethical Growth

- The Green Wave: Sustainable Investing Takes Center Stage In Global Markets

- Green Is The New Gold: Sustainable Investment Takes Center Stage In Global Markets

Thus, we hope this article has provided valuable insights into The Wolf of Sustainable Investing: How ESG is Reshaping Global Capital Markets.

E – Environmental:

- Climate Change: Investors are increasingly concerned about the financial risks associated with climate change. They are seeking investments in companies that are reducing their carbon footprint, investing in renewable energy, and adapting to the impacts of climate change.

- Resource Depletion: The depletion of natural resources is another critical environmental concern. Investors are seeking companies that are managing their resource consumption responsibly and promoting circular economy practices.

- Pollution: Pollution, including air, water, and soil contamination, poses significant environmental and health risks. Investors are looking for companies that are reducing their pollution footprint and promoting sustainable practices.

S – Social:

- Human Rights: Investors are demanding that companies respect human rights throughout their operations, including labor rights, fair treatment of workers, and responsible sourcing.

- Diversity and Inclusion: Companies are being evaluated on their commitment to diversity and inclusion, both in their workforce and in their supply chains. Investors are seeking companies that promote equal opportunity and foster a diverse and inclusive workplace.

- Social Impact: Investors are increasingly interested in investments that generate positive social impact, such as affordable housing, healthcare access, and education.

G – Governance:

- Corporate Governance: Strong corporate governance practices are essential for responsible and ethical business conduct. Investors are looking for companies with independent boards of directors, transparent financial reporting, and robust risk management systems.

- Anti-Corruption: Investors are seeking companies with strong anti-corruption policies and practices to ensure that they are operating ethically and transparently.

- Executive Compensation: Investors are paying close attention to executive compensation practices, seeking to ensure that they are aligned with company performance and shareholder interests.

The Challenges and Opportunities: Navigating the ESG Landscape

The rise of sustainable investing presents both challenges and opportunities for investors, companies, and financial markets:

Challenges:

- Data Transparency and Accuracy: Accurate and reliable ESG data is crucial for investors to make informed decisions. However, data collection and reporting standards are still evolving, leading to inconsistencies and challenges in comparing different companies.

- Greenwashing: Some companies may engage in "greenwashing" by exaggerating their ESG performance or making misleading claims. Investors need to be vigilant and critical in evaluating company ESG claims.

- Investment Returns: While sustainable investing has shown strong performance in recent years, there is no guarantee of consistent outperformance. Investors need to understand the potential risks and rewards of ESG-focused investments.

Opportunities:

- Innovation and Growth: The growing demand for sustainable investments is creating opportunities for companies developing innovative solutions to environmental and social challenges. This could lead to significant economic growth and job creation.

- Improved Risk Management: Companies that prioritize ESG factors are better positioned to manage risks associated with climate change, resource scarcity, and social unrest. This could lead to more resilient and sustainable businesses.

- Global Collaboration: The rise of sustainable investing is fostering global collaboration among investors, companies, and governments to address shared environmental and social challenges.

Conclusion: The Future is Sustainable

The wolf of sustainable investing is no longer at the door; it’s already inside, reshaping the financial landscape. The growing demand for ESG-focused investments is pushing companies to prioritize sustainability, driving innovation, and creating a more responsible and impactful financial system. While challenges remain, the opportunities for positive change are immense. The future of finance is sustainable, and the wolf is leading the way.

We thank you for taking the time to read this article. See you in our next article!