With great pleasure, we will explore the intriguing topic related to Sustainable Investing: A Green Wave Sweeping Global Capital Markets. Let’s weave interesting information and offer fresh perspectives to the readers.

Sustainable Investing: A Green Wave Sweeping Global Capital Markets

The world is waking up to the urgent need for sustainable solutions. This shift in consciousness is not just impacting individual lifestyles but also reshaping the landscape of global capital markets. Investors, driven by a growing awareness of environmental, social, and governance (ESG) factors, are increasingly turning towards sustainable investments, marking a significant transformation in the way capital is allocated and businesses operate.

A Surge in Sustainable Funds: A Telling Indicator

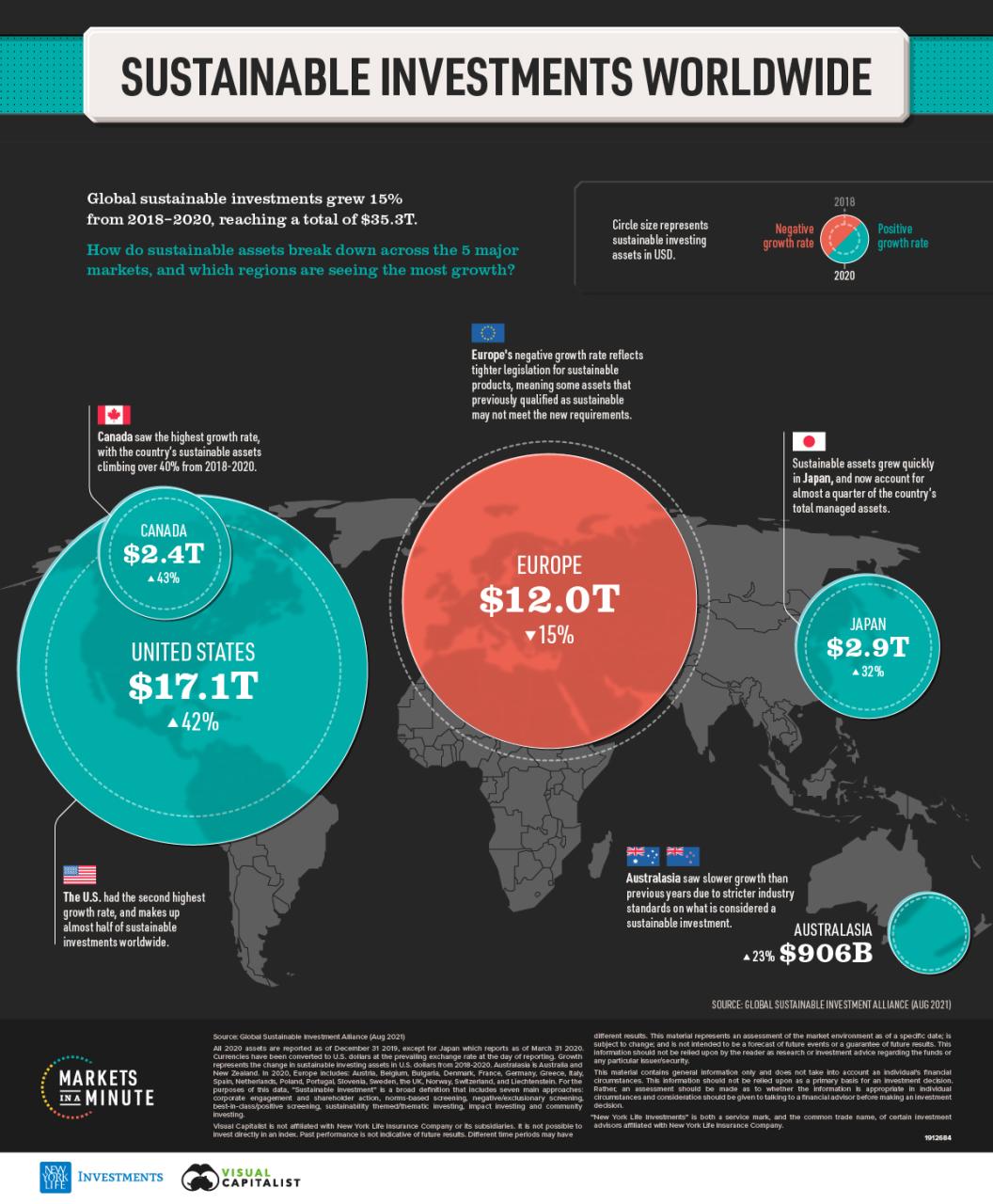

The growth of assets under management (AUM) in sustainable funds is a powerful testament to this trend. According to Morningstar, global sustainable fund AUM reached a record high of $4.1 trillion in 2022, representing a staggering 20% increase from the previous year. This surge indicates a growing appetite for investments that align with ethical and responsible values, as investors seek to contribute to a more sustainable future while generating returns.

Factors Driving the Sustainable Investing Boom

Several key factors are driving this dramatic shift towards sustainable investing:

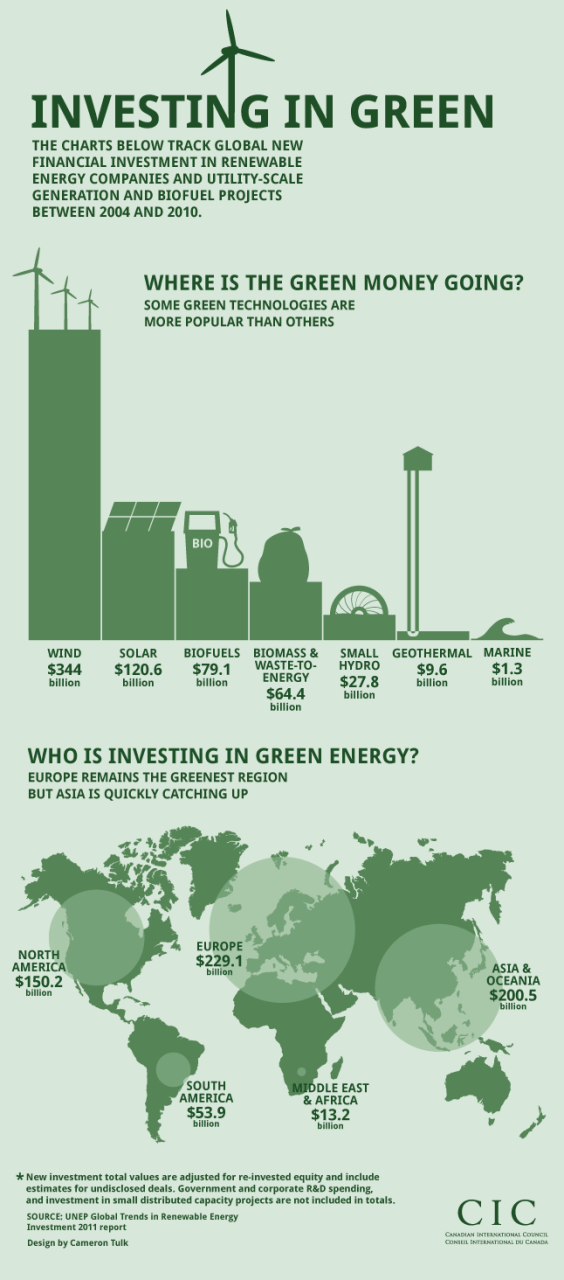

- Growing Awareness of Climate Change and Social Issues: The increasing frequency and severity of climate-related events, coupled with growing awareness of social inequalities, have spurred a sense of urgency among investors. They recognize that addressing these issues is not only ethically imperative but also financially prudent, as sustainable practices can mitigate risks and create long-term value.

- Regulatory Pressure and Policy Support: Governments and regulatory bodies worldwide are increasingly implementing policies and regulations that promote sustainable investing. This includes mandatory ESG reporting requirements, tax incentives for sustainable investments, and the development of green bonds and other sustainable financial instruments.

- Investor Demand for Transparency and Impact: Investors are demanding greater transparency from companies regarding their ESG performance. They want to understand the impact their investments are having on the environment and society, and they are seeking companies that are committed to ethical and sustainable practices.

- Technological Advancements: Technological advancements have made it easier for investors to access information about companies’ ESG performance and to track the impact of their investments. This increased transparency and accessibility have further fueled the growth of sustainable investing.

Sustainable Investing: A Green Wave Sweeping Global Capital Markets

The Impact on Companies and Financial Markets

The rise of sustainable investing is having a profound impact on companies and financial markets:

- Increased Pressure on Companies to Improve ESG Performance: Companies are facing increasing pressure from investors to improve their ESG performance. This is leading to a shift in corporate priorities, with companies investing in renewable energy, reducing their carbon footprint, promoting diversity and inclusion, and improving their governance practices.

- New Opportunities for Sustainable Businesses: Sustainable businesses are attracting more investment capital, giving them a competitive advantage in the market. This is leading to innovation and growth in the sustainable sector, creating new jobs and opportunities.

- Shifting Investment Strategies: Investors are increasingly incorporating ESG factors into their investment decisions, leading to a shift in investment strategies. This includes the development of new investment products, such as ESG-focused mutual funds and ETFs, and the integration of ESG considerations into traditional investment portfolios.

- Greater Transparency and Accountability: The rise of sustainable investing is leading to greater transparency and accountability in financial markets. Companies are being held to higher standards of disclosure and reporting, and investors are becoming more informed about the ESG performance of their investments.

Challenges and Opportunities

While the growth of sustainable investing is a positive development, it is important to acknowledge the challenges and opportunities associated with this trend:

Challenges:

- Greenwashing: Some companies may engage in "greenwashing," making misleading claims about their sustainability practices to attract investors. This can erode trust in the sustainable investing market and make it difficult for investors to identify genuinely sustainable companies.

- Lack of Standardization: There is currently no universally accepted standard for measuring ESG performance, making it difficult to compare companies and investments. This lack of standardization can hinder the development of a robust sustainable investing market.

- Limited Data Availability: Data on ESG performance is often limited and unreliable, making it difficult for investors to assess the true impact of their investments. This lack of data can make it challenging to identify and invest in genuinely sustainable companies.

Challenges and Opportunities

Opportunities:

- The Golden Age Of Sustainable Investing: Whiskey Investors Seek A Sip Of Ethical Growth

- The Wolf Of Sustainable Investing: How ESG Is Reshaping Global Capital Markets

- A Green Tide: Sustainable Investing Surges In Global Capital Markets

- Green Is The New Gold: Sustainable Investment Takes Center Stage In Global Markets

- The Green Wave: Sustainable Investing Takes Center Stage In Global Markets

- Innovation and Job Creation: The growth of sustainable investing is creating new opportunities for innovation and job creation in the sustainable sector. This includes the development of new technologies, products, and services that address environmental and social challenges.

- Increased Investor Engagement: Sustainable investing is encouraging greater investor engagement with companies, leading to a more active and vocal investor community. This increased engagement can help to drive positive change in corporate behavior.

- Global Collaboration: Sustainable investing is promoting global collaboration on environmental and social issues. Investors, governments, and businesses are working together to develop solutions to address these challenges.

Related Articles: Sustainable Investing: A Green Wave Sweeping Global Capital Markets

Thus, we hope this article has provided valuable insights into Sustainable Investing: A Green Wave Sweeping Global Capital Markets.

Looking Ahead: A Future Shaped by Sustainability

The trend towards sustainable investing is only expected to grow in the coming years. As investors become increasingly aware of the importance of ESG factors, they will demand more transparency and accountability from companies. This will lead to a more sustainable and equitable financial system, where capital is allocated to businesses that are committed to creating a better future for all.

Conclusion

The rise of sustainable investing is a powerful force for change in global capital markets. It is not just a trend but a fundamental shift in the way investors think about risk, return, and impact. By embracing sustainable investments, investors can contribute to a more sustainable future while generating long-term returns. As the world continues to grapple with climate change, social inequality, and other pressing challenges, the role of sustainable investing will only grow in importance, shaping the future of our planet and our economies.

We thank you for taking the time to read this article. See you in our next article!